The world of data management is evolving rapidly, and nowhere is this more apparent than in regulated sectors such as fintech, banking, and healthcare. These sectors rely heavily on robust data infrastructure to ensure operational excellence and adherence to regulatory requirements. At the heart of this infrastructure lies the Extract, Transform, Load (ETL) process—a critical mechanism for consolidating, cleaning, and preparing data for analysis and reporting. However, as the volume, velocity, and variety of data increase, traditional ETL systems often struggle to keep pace.

Enter Roboshift, an AI-driven solution developed by Blocshop to address these challenges head-on. Designed specifically for industries where data integrity and governance are non-negotiable, Roboshift reimagines the ETL process and represents a shift toward smarter, more adaptable data processing.

The limits of traditional ETL in modern data environments

Legacy ETL systems were built to handle structured, predictable datasets in environments where changes were infrequent. For years, this approach sufficed. Businesses could map their data sources, define rigid schemas, and run scheduled batch processes to ensure data availability for reporting. However, the digital transformation of industries, coupled with the rise of big data, has disrupted this status quo.

Modern data sources are diverse—ranging from APIs and cloud-based platforms to real-time event streams. Moreover, regulated industries have unique requirements, such as auditability, detailed logging, and stringent data validation protocols. Traditional ETL tools often fall short in these areas for several reasons:

Rigid architectures: Adapting to new data sources or modifying existing workflows often requires significant development effort.

Manual effort required: Data mapping, transformation logic, and error resolution frequently require expert intervention, delaying projects.

Batch-only processing: Many legacy systems operate on batch schedules, introducing latency that is unacceptable in use cases requiring real-time decision-making.

Data silos: Incomplete integration across systems can hinder an organization’s ability to make well-informed decisions.

Roboshift was designed with these pain points in mind, offering a modern, AI-enhanced alternative that not only meets today’s data demands but anticipates tomorrow’s challenges.

How Roboshift redefines ETL with AI

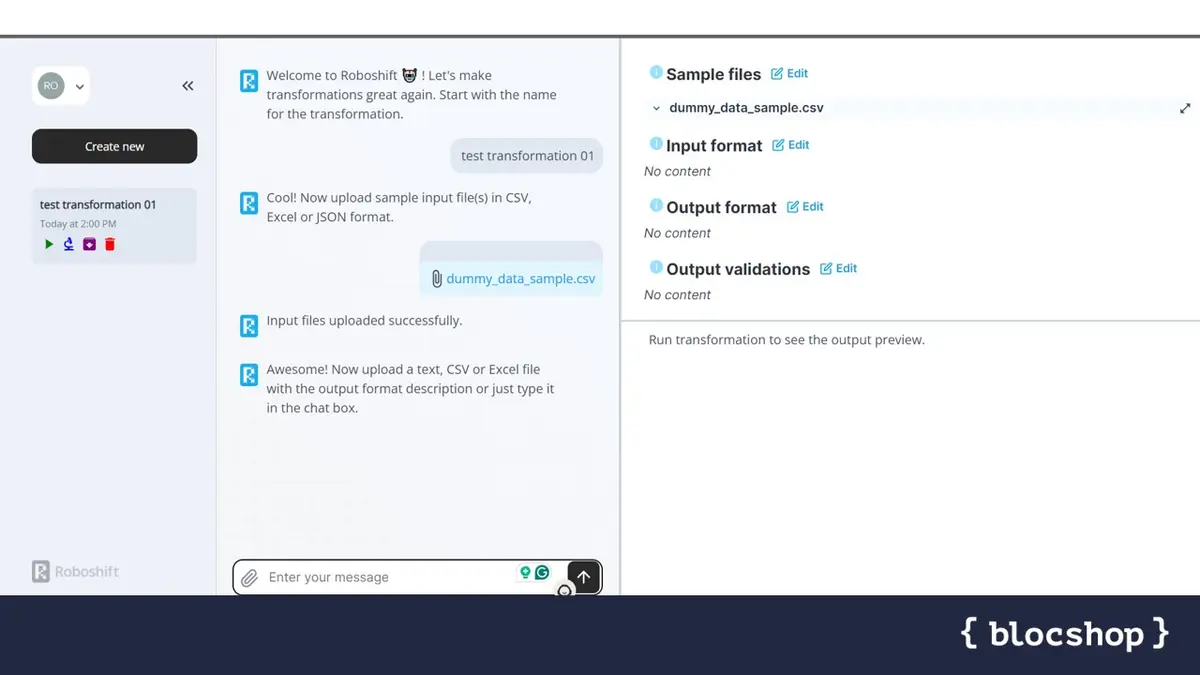

At its core, Roboshift leverages artificial intelligence to enhance every stage of the ETL process—extracting data from diverse sources, transforming it to meet business and regulatory requirements, and providing it to target systems for analysis. What sets Roboshift apart is its ability to integrate seamlessly into existing workflows while reducing dependency on technical expertise thanks to its conversational AI-based interface and data handling.

AI-powered data categories and column mapping

One of the most time-consuming aspects of ETL processes is mapping data categories and columns from source systems to target schemas. Roboshift’s AI algorithms automatically identify potential mappings, significantly reducing the manual effort required. When uncertainties arise, the system engages users through a conversational interface, asking clarifying questions to ensure accuracy.Dynamic transformation logic

Roboshift allows users to define transformation rules without needing to write complex code. Its AI engine understands user inputs in plain language, converting them into precise instructions for data manipulation. This makes it possible for business analysts to take on roles traditionally reserved for developers, enabling faster iteration and implementation.Real-time feedback and error detection

Before committing transformations to production, users can test their workflows in real-time. Roboshift provides immediate feedback on potential errors, ensuring that issues are addressed before they impact downstream processes.Offline processing for enhanced security

For industries like banking and healthcare, data privacy is a top priority. Roboshift’s offline processing capabilities allow sensitive data to remain within secure environments while still benefiting from AI-powered transformations. This feature is particularly critical for organizations subject to regulations such as GDPR or HIPAA.

Meeting the needs of regulated industries

In regulated sectors, data is not just an operational asset; it is a compliance imperative. For example, financial institutions must meet strict reporting standards, ensure data lineage, and maintain audit trails. Healthcare organizations face similar pressures, with the added complexity of safeguarding patient information. Roboshift is uniquely suited to these environments because it was designed with regulatory requirements in mind.

Enhanced auditability and traceability

Every transformation performed by Roboshift is logged in detail, creating a comprehensive record of data lineage. This ensures that organizations can demonstrate compliance during audits and identify the root causes of any discrepancies. The system also supports role-based access control, limiting who can view or modify sensitive data workflows.

Automated data validation

Compliance often hinges on data accuracy. Roboshift includes built-in validation rules tailored to industry-specific requirements, ensuring that data meets both business and regulatory standards before it reaches critical systems. For example, in banking, the system can verify that account numbers conform to IBAN formats or that transactions comply with anti-money laundering (AML) regulations.

Adaptability to changing regulations

One of the most significant challenges in regulated industries is the constant evolution of compliance standards. Roboshift’s AI-driven architecture makes it easier to adapt workflows to meet new requirements. Users can update transformation rules and validation logic without needing to rebuild entire pipelines, reducing both downtime and development costs.

The benefits of AI-driven ETL

While the technical capabilities of Roboshift are impressive, the true value lies in its impact on organizations. By automating routine tasks and augmenting human expertise, Roboshift enables businesses to focus on higher-value activities such as strategic planning and innovation. The benefits include:

1. Increased efficiency

Automation reduces the time and effort required for data integration, allowing teams to complete projects faster. For example, a financial institution might use Roboshift to consolidate transaction data from multiple systems overnight, making it available for analysis at the start of the business day.

2. Greater agility

Businesses and organizations need the ability to adapt quickly, nowadays. Roboshift’s intuitive interface and flexible architecture make it easy to modify workflows in response to new data sources or business requirements.

3. Cost savings

By reducing dependency on specialized technical resources and minimizing errors, Roboshift helps organizations lower their operational costs. Additionally, its ability to scale with growing data volumes ensures that costs remain manageable as businesses expand.

Real-world applications of Roboshift

The potential applications for Roboshift are vast, particularly in regulated industries. Consider the following scenarios:

Regulatory reporting in fintech: A fintech company automates the preparation of compliance reports, ensuring that all required data fields are populated and validated without manual intervention.

Patient data integration in healthcare: A hospital consolidates electronic health records (EHR) from multiple systems, creating a unified view of patient histories while maintaining compliance with data privacy laws.

These examples illustrate how Roboshift’s capabilities go beyond traditional ETL.

Why Roboshift is the right choice for your business

Choosing the right ETL solution is a strategic decision that can have far-reaching implications. For organizations operating in regulated industries, the stakes are even higher.

Roboshift offers a unique combination of advanced technology, user-friendly design, and a deep understanding of industry requirements. Whether you’re looking to improve data quality, accelerate project timelines, or strengthen compliance efforts, Roboshift delivers.

By integrating AI into the ETL process, Blocshop has created a tool that addresses today’s challenges and positions businesses for future success. Roboshift empowers organizations to harness the full potential of their data, driving insights, efficiency, and innovation.

Take the next step

If you’re ready to transform how your organization handles data, it’s time to see how Roboshift can transform your ETL processes in action, enhance quality of your data, and help you meet regulatory requirements with ease.